Why investing in the conservation of the Cerrado biome is good business for investors and farmers

The Bio2me model is based on the operation of farms and production of native bioactive products with significant financial returns in the last 20 years. Without the felling of any trees.

When entrepreneurs Claudio Fernandes and Marcio Campos conceived Bio2me, they were looking for an alternative way to generate income from a property Fernandes had inherited from his father. Along the way, they saw the opportunity to develop a business model based on the richness of the biodiversity in the Cerrado biome.

They started the business almost two and a half years ago and conceived Bio2me to manage farms using a model that promotes the sustainable management of native vegetation and areas needing recovery—a model that combines professional management, specialized and multidisciplinary teams, coupled with artificial intelligence technologies that allow for the identification of bioactive species of great commercial value found in these areas.

The business has attracted the attention of investors, farmers, and even industry.

Antònio Nuno Verças, a professional from the financial market and former president of Banco Cetelem, and Vicente Parente, who works in real estate with over 30 years’ experience in this area, embraced the idea as soon as they heard about it and became angel investors in the company in 2022. Their unique and complementary expertise provided valuable insights to the development of the company and also offered support in rounds of presentations of the startup at trade fairs and events for other potential investors.

Market for bioactive products

Projections indicate that the return in five years could be double the amount invested in the marketing of bioactive products. In 20 years, the gains can be even more substantial, with annual rates of return of between 20-25%.

“It takes an average of seven years for a baru tree (dipteryx alata) to develop, but once they reach adult stage, the trees bear fruit for many, many years. On the other hand, the process itself doesn’t require continuous investment as in the case of traditional agribusiness, which involves annual planting, the acquisition of heavy machinery, intensive use of pesticides, among other investments. We are also investing in a seedling nursery which, in the future, will accommodate even more productive species based on genetic improvement. Other management techniques also increase our productivity,” explains Fernandes, the company’s CEO.

All this without resorting to monoculture, but rather to intercropping with other species, preserving the current conditions.

“To illustrate, compared to a more traditional crop such as soybeans, for example, one hectare of baru or fava d’anta is expected to generate revenues of around R$40,000 in seven years. One hectare of soybeans yields an average income of R$10,000 per crop year. In terms of profitability, soy can generate between 10-20%, but our estimate with bioactive products is between 30-40%,” adds Campos, CFO of Bio2me.

The initial production comes from the purchase of bioactive products from smallholder farmers and cooperatives, which is also essential to help structure the production chain. They are processed in a small industrial unit set up by Bio2me in Vila Boa, GO prior to marketing. In 2023, in a pilot harvest, 100 tons of baru nuts were purchased—a volume that will increase tenfold in 2024 reaching 1,000 tons. The baru harvest runs from August to October.

Nevertheless, the business should really gain scale with investments in areas given in partnership or leased for the management and production of bioactive products. To this end, the company expects to attract between R$8 million and R$10 million in investment rounds. These funds will streamline operations—from leasing of land to structuring the company, which already has 22 employees.

“In the first year of operation we will have 10,000 hectares under our management and our goal is to manage 300,000 hectares in five years,” adds Campos.

The focus is to manage farms using a professional, technical, and specialized approach, as well as governance processes and technology in preservation areas or those needing recovery. Even private protected areas or areas with surplus of native vegetation on rural properties can represent opportunities to generate additional income for farmers who, together with investors, make up the company’s target audience of clients and partners.

Why I invested in Bio2me

“My process is very much about believing in the idea and this basically has three components: firstly, whether it is viable and has traction at the moment, that is, in the case of the bioeconomy, to take advantage of bioactive products that cater to increasingly necessary value chains; the second factor is scalability, especially given the size of Brazil; and the third is the founders’ commitment to the project. I saw someone who believes that preservation is important, who believes that these Brazilian bioactive products have a great value.

I can visualize a capacity to greatly multiply the figures. We’ve already run some projections. We’ve been extremely conservative, because the numbers really are huge.

In addition, I’m the father of four, so for me, long term goes beyond my own existence, it is something that concerns me.”

Antònio Nuno Verças, Angel Investor. Professional in the financial market, former president of Banco Cetelem, the investment arm of BNP Paribas in Brazil, and operations manager in the finance and energy sectors.

Opportunities for financial return

The possibilities for financial gains are countless: considering baru alone It is gaining the status of a superfood due to its nutritional value, even attracting the attention of the cosmetics industry. The fruit can be used entirely: the nut has a high nutritional value, as does the pulp—which can be used as flour for making bread and cakes—as well as the shell, which can be turned into biomass for the generation of energy. The tree can also provide shade and food for livestock. Studies conducted by EMBRAPA Cerrado have shown the viability of the baru tree (baruzeiro) in ILPF systems (Initials in Portuguese for ‘Crop-Livestock-Forest Integration’).

Other species native to the Cerrado biome are also being evaluated by Bio2me, which in February 2024 had already processed its first harvest of fava d’anta, the fruit of a leguminous tree which, among other characteristics, produces bioflavonoids with pharmaceutical properties. And Bio2me intends to look for new bioactive products with a similar profile—a guarantee of revenue generation while preserving the native vegetation and the Cerrado biome.

According to an article published in the market survey magazine Fact.MR and released by EMBRAPA Cerrados, sales of baru are expected to grow by 25% a year between 2019 and 2029. Currently, nearly half of its production is exported—25% to Europe and another 22% to the United States. “Such a huge leap in market appraisal stems from the global demand for baru nuts, which is likely to skyrocket at a 24.8% CAGR by 2032,” according to Fact.MR’s article, which points out that, in addition to food products, interest in baru is growing in the cosmetics and personal care industry.

And if none of these appeals are enough to attract the interest of the market, the appreciation of the land alone is a guaranteed return on investment. The agricultural activity in the region chosen for the start of Bio2me’s operations, northeastern Goiás, is not as intense, with low-cost land—compared to more valued regions—and has higher rates of preservation. The area has been receiving improvements and infrastructure work, such as paving and building of bridges. It is expected that the price of the hectare of land will double over the next five years.

“It’s an investment with the soundness of the agribusiness,” adds Parente, with his experience in the real estate market. This was one of the aspects that drew his attention to the investment.

The knowledge of the founders and their proximity to the fields are other valued attributes. Fernandes and Campos, from Rio de Janeiro, talk confidently about the types of vegetation of the Cerrado biome, seedling development, and management techniques. They make a point of knowing and understanding the region. Fernandes was already a farmer. Together with Campos, he visits the properties on a regular basis, with the support of the local Bio2me team. On some of these visits, they take investors to see firsthand the reality of the region.

“We have a team with cross-disciplinary skills, ranging from local professionals who know and have experienced the Cerrado fruit chain all their lives, to market professionals with experience in operations, sales, and portfolio development. Everyone is dedicated to finding the best land, connecting it to major investors and building the production chain from seed to table,” said the CEO of the Bio2me group, which is also formed by complementary businesses that include id2t, which developed technology based on AI and IoT, a nursery for the production of seeds and seedlings native to the Cerrado biome, and Vista, a food processing industry. Completing the group is Be+, the social arm that works to train communities in the sustainable management of bioactive products.

Why I invested in Bio2me

“One of the main reasons that led me to invest in agribusiness is its stability. Aside from the potential for land appreciation, it represents an anchor for investors.

And Bio2me offers a different approach to traditional agribusiness, in the way it should be dealt with from now into the future, combining technological and operational innovation. We are not a threat to traditional agribusiness. We are not opponents. Quite the opposite, we’re partners! We promote a complementary business, adjusting these traditional producers, whether they grow soybeans or corn, to also monetize their private protected areas. Our proposal is to develop these areas, managing their assets in a sustainable way, providing landowners with alternative sources of income, while also combining environmental preservation and a positive social impact.

I’m very confident that this undertaking has everything it takes to yield good results for investors and partners while leaving a legacy of respect for the environment for future generations.”

Vicente Parente, Angel Investor. Real estate professional with over 30 years’ experience in the real estate market.

The business has stood out among companies and organizations such as the Cerrado Sustainable Soy Program (PSSC in the initials in Portuguese), that foster solutions for agricultural development free of deforestation and land use conversion, led by AgTech, part of the PwC network, and the Land Innovation Fund (LIF), with strategic support from Cargill, CPQD, EMBRAPA, and EMBRAPII. Bio2me was one of the startups selected in 2023 and used its neural network system to map soy-producing farms with the potential to also produce bioactive products from the Cerrado. In addition to this partnership, Nestlé chose Bio2me to integrate its open innovation platform, the Panela Nestlé, for the 2024 cycle.

These are demonstrations of the work potential planned by Fernandes and Campos and of the region’s need for new ideas, models, and technologies that can support the sustainable development of agribusiness.

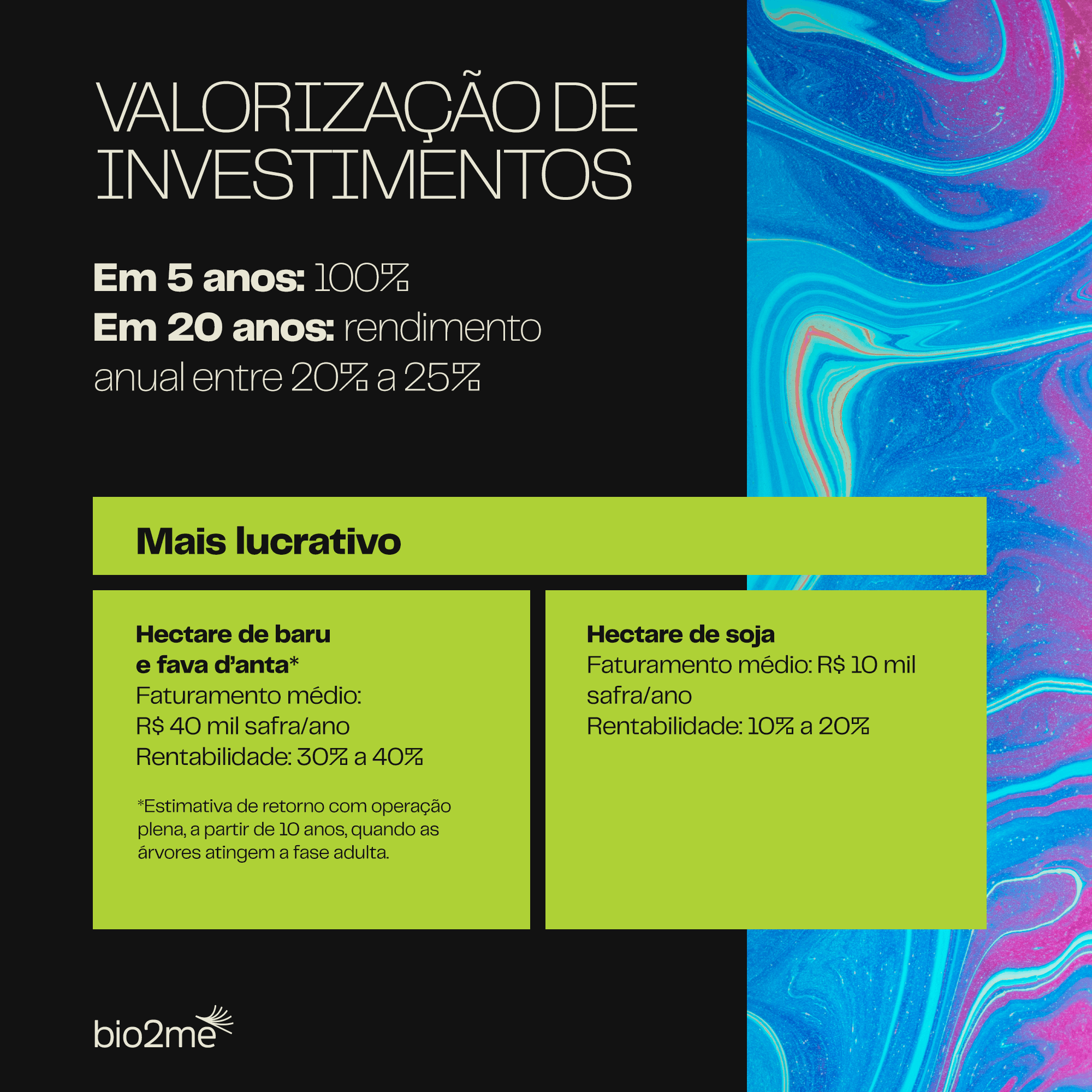

Appreciation of investments

In 5 years: 100%

In 20 years: yield between 20-25% per year

More profitable

Hectare planted with baru and fava d’anta*

Average sales: R$40,000 crop/year

Yield: 30-40%

*Expected return with full operation, after year 10, when the trees reach their adult phase.

Hectare of soy

Average sales: R$10,000 crop/year

Yield: 10-20%